A 1099 NEC Form is an important document needed for tax purposes. It is used to report nonemployee compensation, such as freelancer income, to the Internal Revenue Service (IRS). Whether you are a business owner or a freelancer, understanding this form is crucial to ensure compliance with tax regulations. Let’s take a closer look at what the 1099 NEC Form entails and why it matters.

1099 NEC Form for Tax Year 2020

The 1099 NEC Form for Tax Year 2020 is a printable document that captures essential information about nonemployee compensation. It is used by businesses and individuals to report payments made to independent contractors, freelancers, and other self-employed individuals.

The 1099 NEC Form for Tax Year 2020 is a printable document that captures essential information about nonemployee compensation. It is used by businesses and individuals to report payments made to independent contractors, freelancers, and other self-employed individuals.

Understanding 1099 Form Samples

It is crucial to understand the different samples of the 1099 Form. This will ensure that you accurately fill out the form and report the correct information. The form captures various payment types, including fees, commissions, prizes, and other forms of compensation.

It is crucial to understand the different samples of the 1099 Form. This will ensure that you accurately fill out the form and report the correct information. The form captures various payment types, including fees, commissions, prizes, and other forms of compensation.

Preparing for JD Edwards Year-End

For businesses using JD Edwards, it is essential to prepare for year-end activities. This includes ensuring that the 1099 NEC Forms are correctly filled out and submitted to the IRS. Taking the time to prepare in advance will help avoid any last-minute rush or errors in reporting.

For businesses using JD Edwards, it is essential to prepare for year-end activities. This includes ensuring that the 1099 NEC Forms are correctly filled out and submitted to the IRS. Taking the time to prepare in advance will help avoid any last-minute rush or errors in reporting.

Free Printable 1099 NEC Form

If you are looking for a free printable 1099 NEC Form, you are in luck. Various online platforms offer downloadable versions of the form. Saving money and time is a bonus, especially during tax season.

If you are looking for a free printable 1099 NEC Form, you are in luck. Various online platforms offer downloadable versions of the form. Saving money and time is a bonus, especially during tax season.

Explaining All Form 1099 Types

Form 1099 comes in different types, each capturing specific payment information. Understanding the differences between these forms is crucial to properly report income and fulfill your tax obligations. The most common include 1099-MISC, 1099-INT, and of course, 1099-NEC.

Form 1099 comes in different types, each capturing specific payment information. Understanding the differences between these forms is crucial to properly report income and fulfill your tax obligations. The most common include 1099-MISC, 1099-INT, and of course, 1099-NEC.

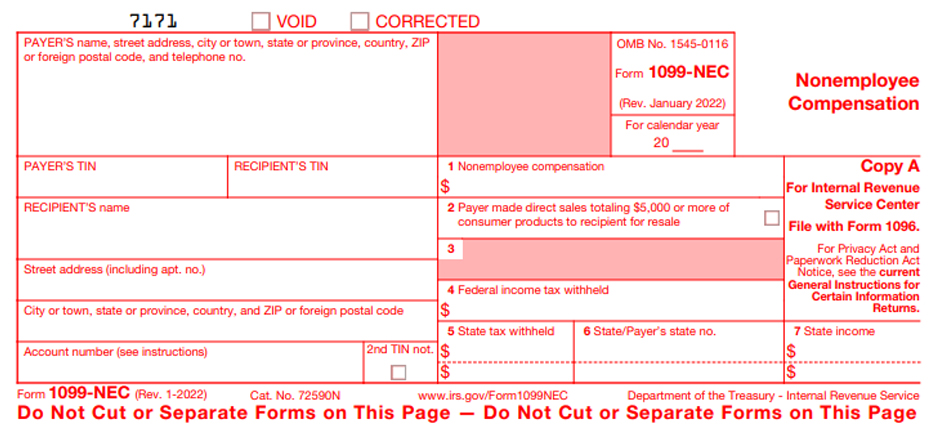

Form 1099-NEC for 2022

Looking ahead to the coming year, it is important to familiarize yourself with the changes in the 1099-NEC form for 2022. Staying updated on any modifications will ensure accurate reporting and compliance with IRS guidelines.

Looking ahead to the coming year, it is important to familiarize yourself with the changes in the 1099-NEC form for 2022. Staying updated on any modifications will ensure accurate reporting and compliance with IRS guidelines.

How to Fill Out Form 1099-NEC

Filling out Form 1099-NEC correctly is essential to avoid any penalties or issues with the IRS. There are specific instructions to follow, and understanding how to complete the form will make the process much smoother.

Free Printable 1099 NEC Form 2022

As you prepare for tax year 2022, finding a free printable 1099 NEC Form will save you time and money. It is always beneficial to have the necessary forms readily available for efficient tax preparation and filing.

As you prepare for tax year 2022, finding a free printable 1099 NEC Form will save you time and money. It is always beneficial to have the necessary forms readily available for efficient tax preparation and filing.

What is Form 1099-NEC and Who Needs to File?

Form 1099-NEC is used to report nonemployee compensation and is required to be filed by businesses or individuals who have paid at least $600 to freelancers, independent contractors, or other self-employed individuals during the year. It is important to understand the filing requirements to avoid any penalties.

Form 1099-NEC is used to report nonemployee compensation and is required to be filed by businesses or individuals who have paid at least $600 to freelancers, independent contractors, or other self-employed individuals during the year. It is important to understand the filing requirements to avoid any penalties.

Overall, the 1099 NEC Form plays a vital role in tax reporting for businesses and individuals alike. Understanding how to fill out the form correctly, staying updated on any changes, and ensuring compliance with IRS guidelines are all crucial steps. Using the available resources, such as free printable forms and instructions, can make the process smoother and more efficient. Remember to consult with a tax professional if you have any specific questions or concerns regarding the 1099 NEC Form and its requirements.