Fillable 1099 Nec Forms - Printable Forms Free Online

Are you looking for fillable 1099 Nec forms? Look no further! We have got you covered. In this digital era, it’s essential to have access to printable forms that can be easily filled out online. Whether you are a freelancer, independent contractor, or small business owner, the 1099 Nec form is a crucial document for reporting nonemployee compensation. It ensures compliance with the Internal Revenue Service (IRS) regulations and helps you avoid penalties or legal issues in the future.

Are you looking for fillable 1099 Nec forms? Look no further! We have got you covered. In this digital era, it’s essential to have access to printable forms that can be easily filled out online. Whether you are a freelancer, independent contractor, or small business owner, the 1099 Nec form is a crucial document for reporting nonemployee compensation. It ensures compliance with the Internal Revenue Service (IRS) regulations and helps you avoid penalties or legal issues in the future.

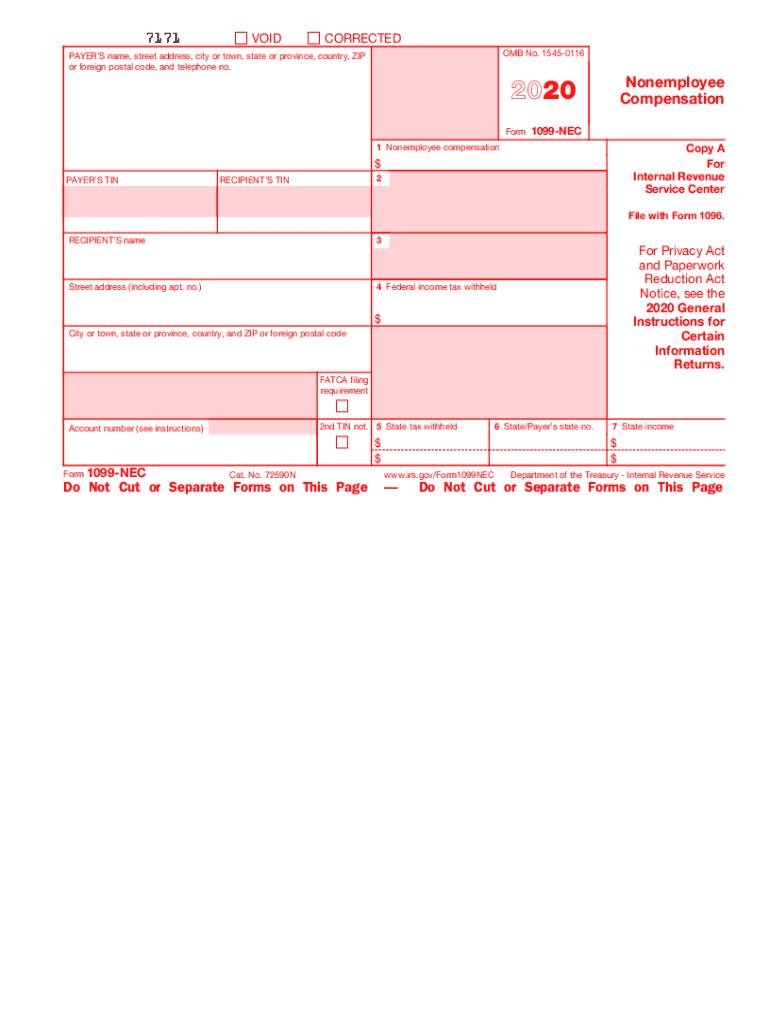

1099 Nec Form 2020 Printable - Printable World Holiday

It’s that time of the year when tax-related forms start flooding in. Don’t stress, though, because we have the perfect solution for you. Our printable 1099 Nec form for the year 2020 is readily available, ensuring you can easily report your nonemployee compensation. With just a few clicks, you can fill out the necessary information and get everything ready for a hassle-free tax season. Don’t let complicated tax forms overwhelm you; use our printable forms and enjoy your holidays without any worries.

It’s that time of the year when tax-related forms start flooding in. Don’t stress, though, because we have the perfect solution for you. Our printable 1099 Nec form for the year 2020 is readily available, ensuring you can easily report your nonemployee compensation. With just a few clicks, you can fill out the necessary information and get everything ready for a hassle-free tax season. Don’t let complicated tax forms overwhelm you; use our printable forms and enjoy your holidays without any worries.

[\u6700\u3082\u9078\u629e\u3055\u308c\u305f] form 1099-nec schedule c instructions 231161-How to fill out

If you are wondering how to fill out form 1099-nec schedule c instructions, you have come to the right place. We understand that tax forms can be confusing, but with our detailed instructions, you can easily navigate through the process. Our step-by-step guide will walk you through each section of the form, ensuring accurate reporting of your nonemployee compensation. Leave the stress of tax preparation behind and follow our instructions for a seamless experience.

If you are wondering how to fill out form 1099-nec schedule c instructions, you have come to the right place. We understand that tax forms can be confusing, but with our detailed instructions, you can easily navigate through the process. Our step-by-step guide will walk you through each section of the form, ensuring accurate reporting of your nonemployee compensation. Leave the stress of tax preparation behind and follow our instructions for a seamless experience.

Printable Form 1099 - Printable Forms Free Online

Looking for a printable form 1099? You’re in luck! Our platform provides a wide range of printable forms that can be accessed online for free. Whether you need to report nonemployee compensation or any other tax-related information, our user-friendly interface makes it easy to fill out the form digitally. Say goodbye to paper forms and the hassle of manual calculations. Opt for our printable forms and experience a convenient way to fulfill your tax obligations.

Looking for a printable form 1099? You’re in luck! Our platform provides a wide range of printable forms that can be accessed online for free. Whether you need to report nonemployee compensation or any other tax-related information, our user-friendly interface makes it easy to fill out the form digitally. Say goodbye to paper forms and the hassle of manual calculations. Opt for our printable forms and experience a convenient way to fulfill your tax obligations.

Fillable 1099 Nec Forms - Printable Forms Free Online

Is filing your 1099 Nec form causing you stress? Don’t worry; we have the perfect solution for you. Our platform offers fillable 1099 Nec forms that can be conveniently accessed online. With just a few simple steps, you can fill out the form electronically, saving time and effort. Say goodbye to manual paperwork and embrace the digital era. Choose our printable forms and experience a seamless process for reporting your nonemployee compensation.

Is filing your 1099 Nec form causing you stress? Don’t worry; we have the perfect solution for you. Our platform offers fillable 1099 Nec forms that can be conveniently accessed online. With just a few simple steps, you can fill out the form electronically, saving time and effort. Say goodbye to manual paperwork and embrace the digital era. Choose our printable forms and experience a seamless process for reporting your nonemployee compensation.

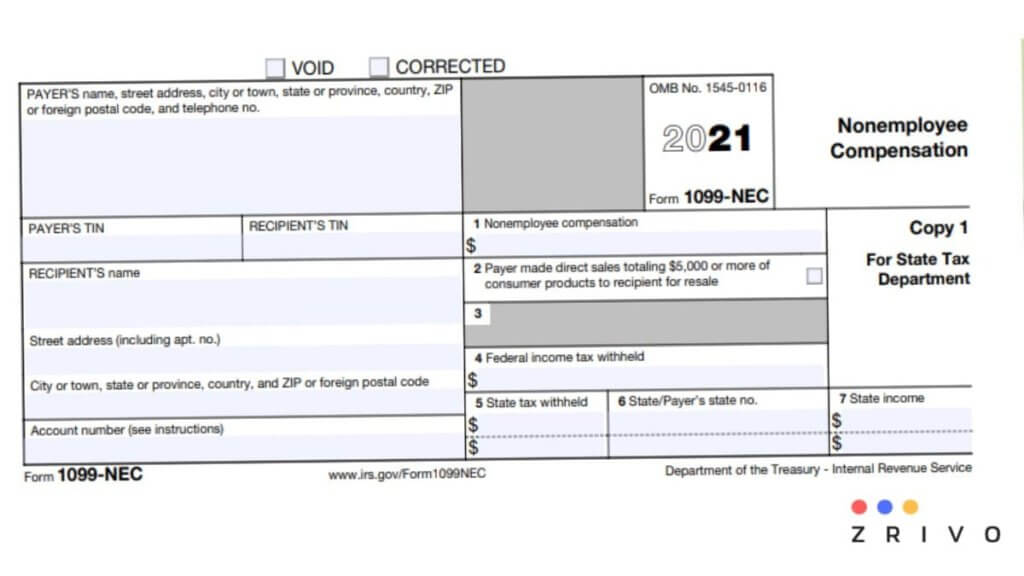

Printable 1099 Nec Form 2021 - Printable World Holiday

The year 2021 brings new challenges and tasks, and one of them is filing your taxes correctly. To make your life easier, we offer a printable 1099 Nec form for the year 2021. By using our digital platform, you can access and fill out the form online. Our printable forms are user-friendly and designed to simplify the tax filing process. Don’t let tax season become a burden; choose our printable forms and enjoy a stress-free experience.

What is Form 1099-NEC and Who Needs to File? – 123PayStubs Blog

If you are unfamiliar with Form 1099-NEC, don’t worry; we are here to provide you with all the information you need. Form 1099-NEC is used to report nonemployee compensation and is required by the IRS. This form is essential for businesses that have paid at least $600 to independent contractors or freelancers during the tax year. By filing this form, businesses ensure compliance with tax regulations and avoid potential penalties or legal issues. Stay informed and meet your tax obligations by filing Form 1099-NEC with ease.

If you are unfamiliar with Form 1099-NEC, don’t worry; we are here to provide you with all the information you need. Form 1099-NEC is used to report nonemployee compensation and is required by the IRS. This form is essential for businesses that have paid at least $600 to independent contractors or freelancers during the tax year. By filing this form, businesses ensure compliance with tax regulations and avoid potential penalties or legal issues. Stay informed and meet your tax obligations by filing Form 1099-NEC with ease.

What Is Form 1099-NEC?

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg) Form 1099-NEC is a tax form used to report nonemployee compensation. It is an important document for businesses to report payments made to independent contractors, freelancers, or consultants. The form helps the IRS track income and ensures that individuals receiving this compensation accurately report it on their tax returns. Compliance with Form 1099-NEC is crucial to avoid penalties and legal issues. Understanding the purpose and requirements of this form is essential for businesses operating in a freelance-driven economy.

Form 1099-NEC is a tax form used to report nonemployee compensation. It is an important document for businesses to report payments made to independent contractors, freelancers, or consultants. The form helps the IRS track income and ensures that individuals receiving this compensation accurately report it on their tax returns. Compliance with Form 1099-NEC is crucial to avoid penalties and legal issues. Understanding the purpose and requirements of this form is essential for businesses operating in a freelance-driven economy.

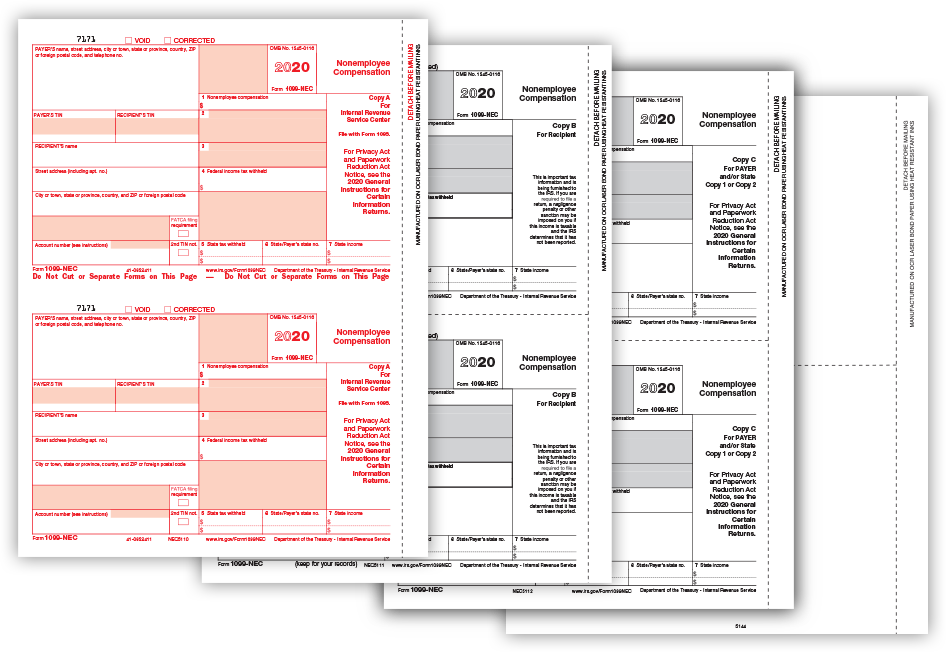

New 1099 NEC Form - 1099 Tax Form changes for 2020 with filings in 2021

With the recent changes in the tax laws, there are new requirements for filing the 1099 NEC form. Business owners and self-employed individuals need to stay updated to comply with the latest regulations. The 1099 NEC form is specifically designed to report nonemployee compensation and is crucial for accurately reporting income. Failure to file this form correctly can result in penalties and audits. Stay ahead of the game and be aware of the changes in tax forms to ensure a smooth and trouble-free tax filing season.

With the recent changes in the tax laws, there are new requirements for filing the 1099 NEC form. Business owners and self-employed individuals need to stay updated to comply with the latest regulations. The 1099 NEC form is specifically designed to report nonemployee compensation and is crucial for accurately reporting income. Failure to file this form correctly can result in penalties and audits. Stay ahead of the game and be aware of the changes in tax forms to ensure a smooth and trouble-free tax filing season.

2021 Form IRS 1099-NEC

The year 2021 brings new tax requirements, and one of them is the 2021 Form IRS 1099-NEC. This form is used to report nonemployee compensation and is essential for businesses and individuals involved in freelancing or independent contracting. By using our platform, you can easily access, fill, and submit the form online. Our printable forms simplify the entire process, ensuring accurate reporting and compliance with the IRS guidelines. Streamline your tax filing with our user-friendly and convenient digital solutions.

The year 2021 brings new tax requirements, and one of them is the 2021 Form IRS 1099-NEC. This form is used to report nonemployee compensation and is essential for businesses and individuals involved in freelancing or independent contracting. By using our platform, you can easily access, fill, and submit the form online. Our printable forms simplify the entire process, ensuring accurate reporting and compliance with the IRS guidelines. Streamline your tax filing with our user-friendly and convenient digital solutions.

In conclusion, when it comes to tax forms like the 1099 Nec, printable forms that are easily accessible online can save time and effort. Our platform offers a wide range of fillable and printable forms, ensuring that businesses and individuals can fulfill their tax obligations accurately. By staying informed and utilizing user-friendly electronic forms, you can streamline your tax filing process, avoid penalties, and ensure compliance with the IRS regulations. Embrace the convenience of printable forms and make tax season a breeze.