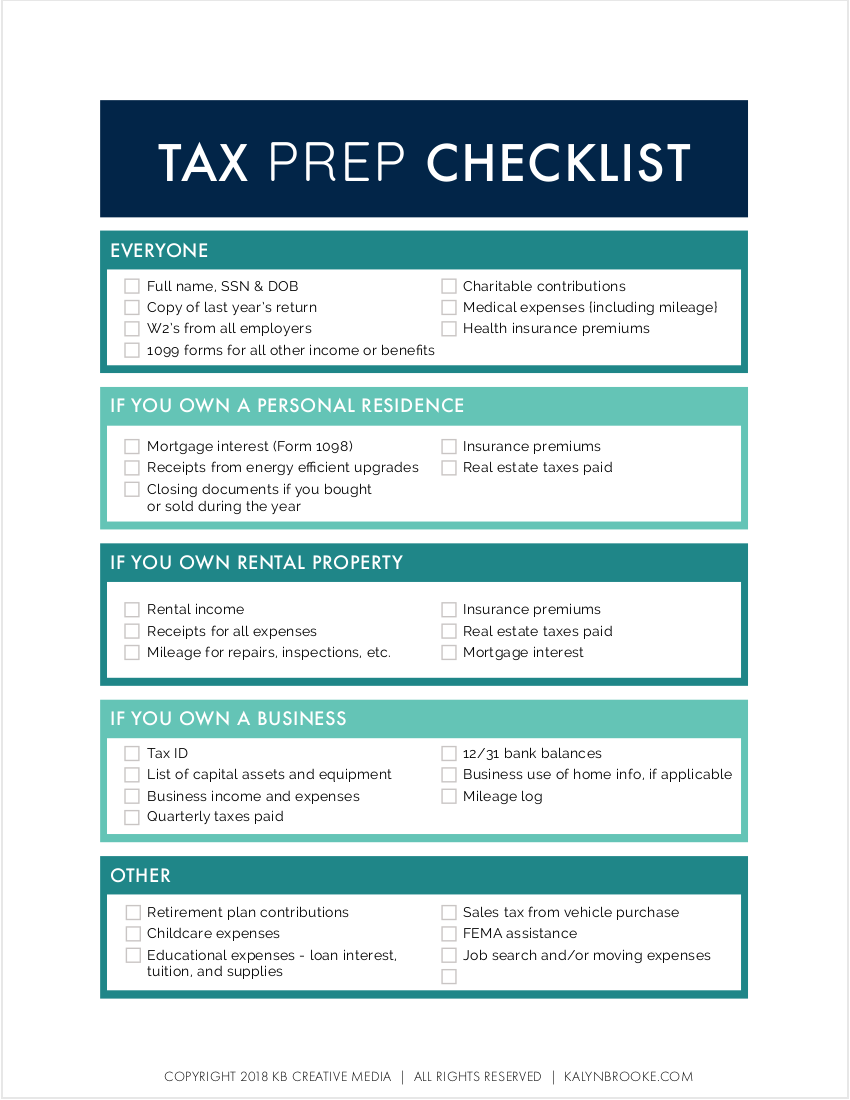

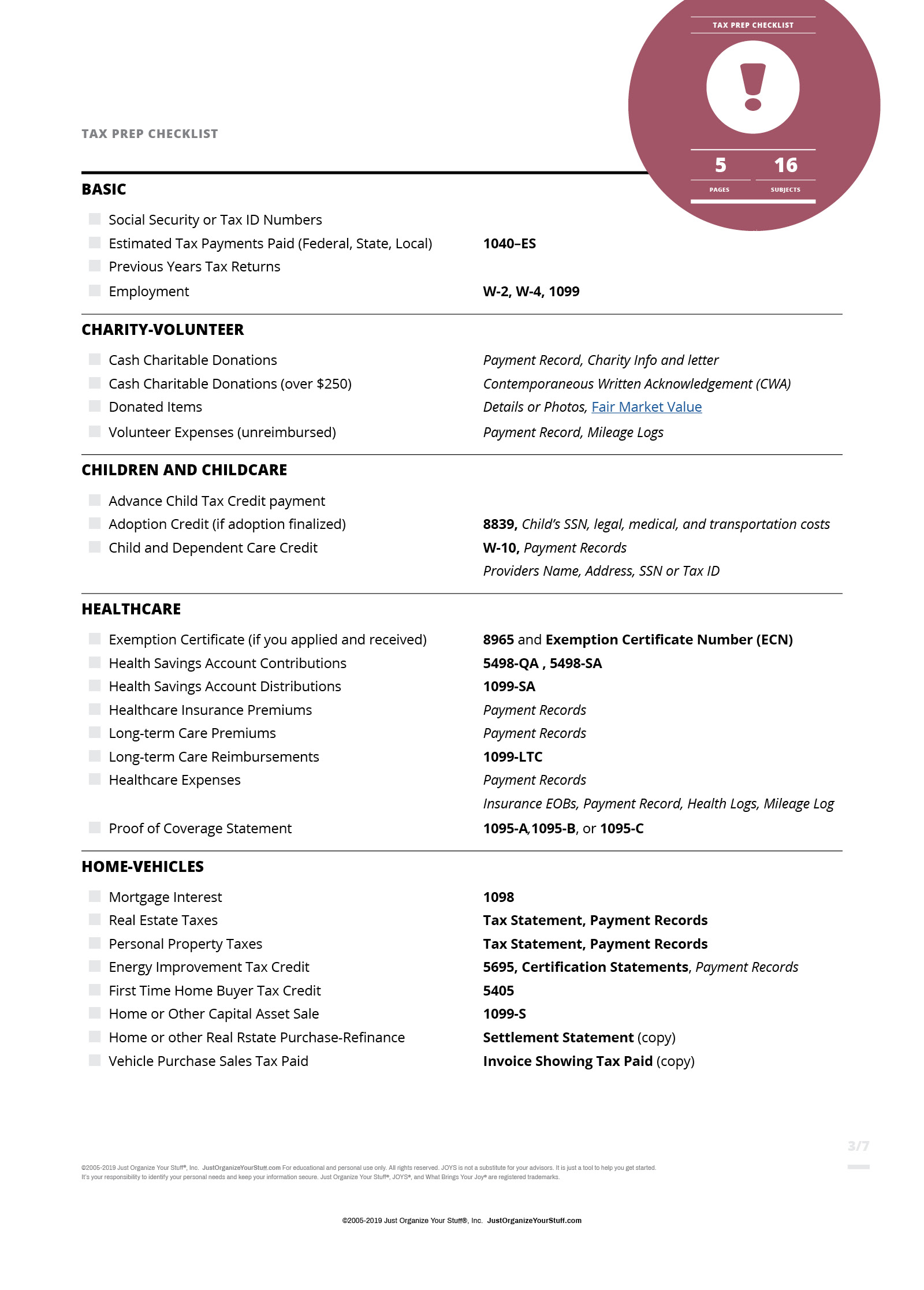

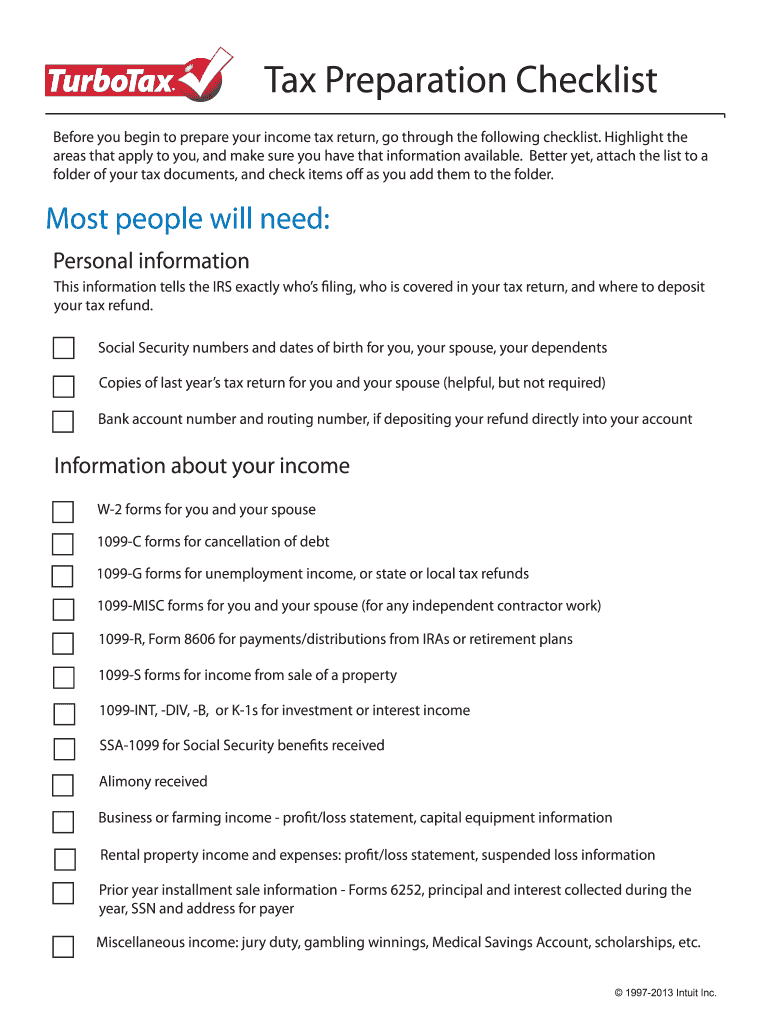

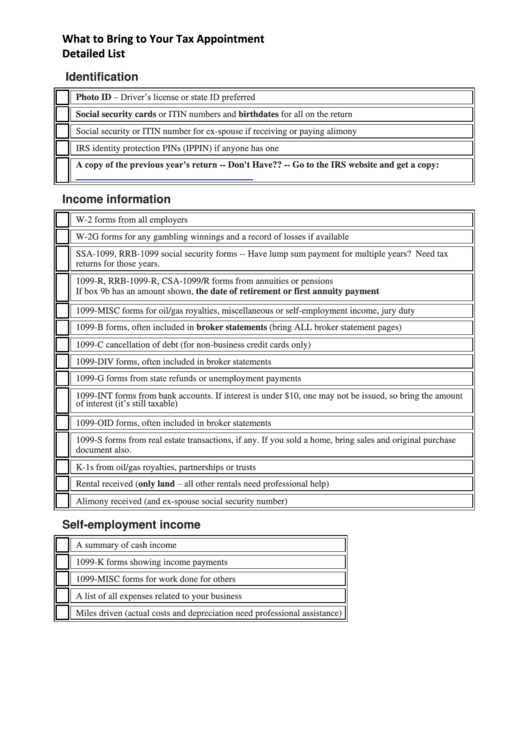

With tax season upon us, it’s time to start thinking about tax preparation. Whether you’re a seasoned pro or a first-time filer, having a tax prep checklist can be incredibly helpful in ensuring you don’t miss any important deductions or credits. Here is a comprehensive list of items you should gather and consider as you prepare to tackle your taxes.

- W-2 Forms

A crucial starting point for tax preparation is gathering all your W-2 forms from each employer you worked for during the tax year. These forms provide essential information about your income and taxes withheld, which you’ll need to accurately file your tax return.

A crucial starting point for tax preparation is gathering all your W-2 forms from each employer you worked for during the tax year. These forms provide essential information about your income and taxes withheld, which you’ll need to accurately file your tax return.

- 1099 Forms

If you received income from sources other than traditional employment, such as freelance work or investments, you may receive 1099 forms. These forms report additional income you need to report on your tax return, so be sure to gather them all.

If you received income from sources other than traditional employment, such as freelance work or investments, you may receive 1099 forms. These forms report additional income you need to report on your tax return, so be sure to gather them all.

- Receipts and Records

Keeping track of your expenses throughout the year is essential for maximizing your deductions. Gather all relevant receipts and records, such as medical expenses, education expenses, charitable contributions, and business expenses, to ensure you can claim eligible deductions.

Keeping track of your expenses throughout the year is essential for maximizing your deductions. Gather all relevant receipts and records, such as medical expenses, education expenses, charitable contributions, and business expenses, to ensure you can claim eligible deductions.

- Property Documents

If you bought or sold property during the tax year, gather all relevant documents, including closing statements, mortgage interest statements (Form 1098), and any property tax bills you paid. These documents will be necessary if you plan to claim deductions related to homeownership.

If you bought or sold property during the tax year, gather all relevant documents, including closing statements, mortgage interest statements (Form 1098), and any property tax bills you paid. These documents will be necessary if you plan to claim deductions related to homeownership.

- Student Loan Interest Statements

If you’re repaying student loans, gather any Form 1098-E statements you received. These forms report the amount of interest you paid on your student loans throughout the tax year. You may be eligible for a deduction on your tax return, reducing your overall tax liability.

If you’re repaying student loans, gather any Form 1098-E statements you received. These forms report the amount of interest you paid on your student loans throughout the tax year. You may be eligible for a deduction on your tax return, reducing your overall tax liability.

- Health Insurance Information

Insurance coverage is an important aspect of tax preparation. Gather any Form 1095-A, B, or C you received, which report information about your health insurance coverage. Make sure to include this information on your tax return to avoid any penalties related to the Affordable Care Act.

Insurance coverage is an important aspect of tax preparation. Gather any Form 1095-A, B, or C you received, which report information about your health insurance coverage. Make sure to include this information on your tax return to avoid any penalties related to the Affordable Care Act.

- Retirement Account Statements

If you contribute to retirement accounts such as a 401(k) or IRA, gather your year-end statements. These statements will provide important details about your contributions and help you claim any applicable deductions or credits related to retirement savings.

If you contribute to retirement accounts such as a 401(k) or IRA, gather your year-end statements. These statements will provide important details about your contributions and help you claim any applicable deductions or credits related to retirement savings.

- Miscellaneous Income Documents

Don’t forget to gather any other income-related documents, such as jury duty pay, gambling winnings, or unemployment compensation. While these may not make up a significant portion of your income, they still need to be reported on your tax return.

Don’t forget to gather any other income-related documents, such as jury duty pay, gambling winnings, or unemployment compensation. While these may not make up a significant portion of your income, they still need to be reported on your tax return.

- Tax Preparation Software

If you plan to use tax preparation software, make sure you have it downloaded and ready to use. Familiarize yourself with the software’s features and processes so that you can efficiently input your information and file your taxes accurately.

If you plan to use tax preparation software, make sure you have it downloaded and ready to use. Familiarize yourself with the software’s features and processes so that you can efficiently input your information and file your taxes accurately.

- Previous Year’s Tax Return

Lastly, have a copy of your previous year’s tax return handy. Reviewing your previous return can help you identify any missing or additional documents you may need for the current tax year. It can also serve as a reference point for comparing year-to-year changes.

Lastly, have a copy of your previous year’s tax return handy. Reviewing your previous return can help you identify any missing or additional documents you may need for the current tax year. It can also serve as a reference point for comparing year-to-year changes.

Remember, this tax preparation checklist is meant to be a comprehensive guide to help you stay organized during tax season. It is always advisable to consult a tax professional or use reputable tax preparation software to ensure accuracy and maximize your tax benefits. By gathering all the necessary documents and information, you can ensure a smooth and successful tax filing process.