When it comes to filling out the W-4 form, it’s important to understand the instructions and provide accurate information to avoid any issues with your taxes. To help you navigate this process, we have compiled a list of resources and samples of the W-4 form for the year 2020 and 2021.

Sample Of W 4 2021 Filled Out - 2022 W4 Form

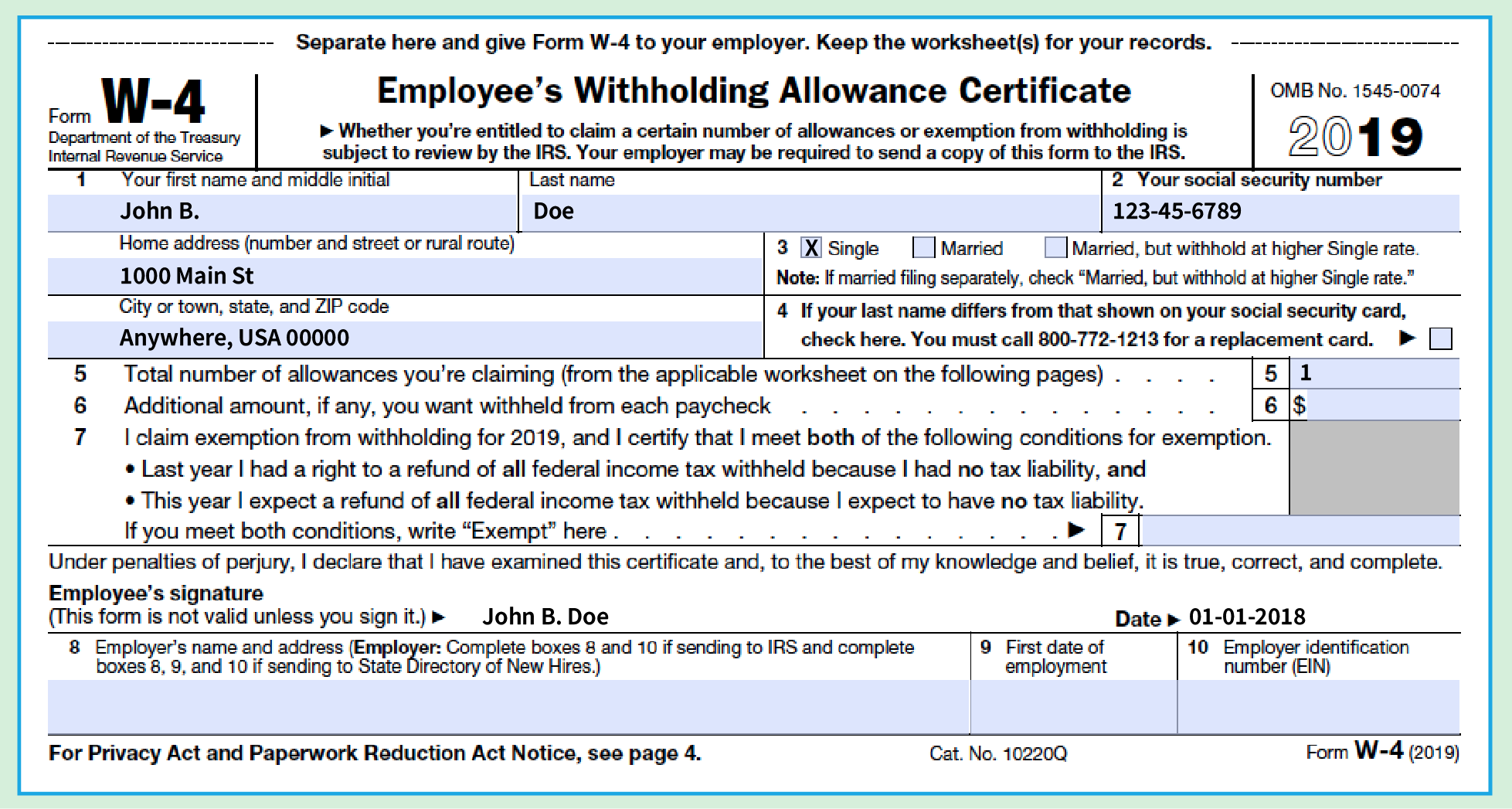

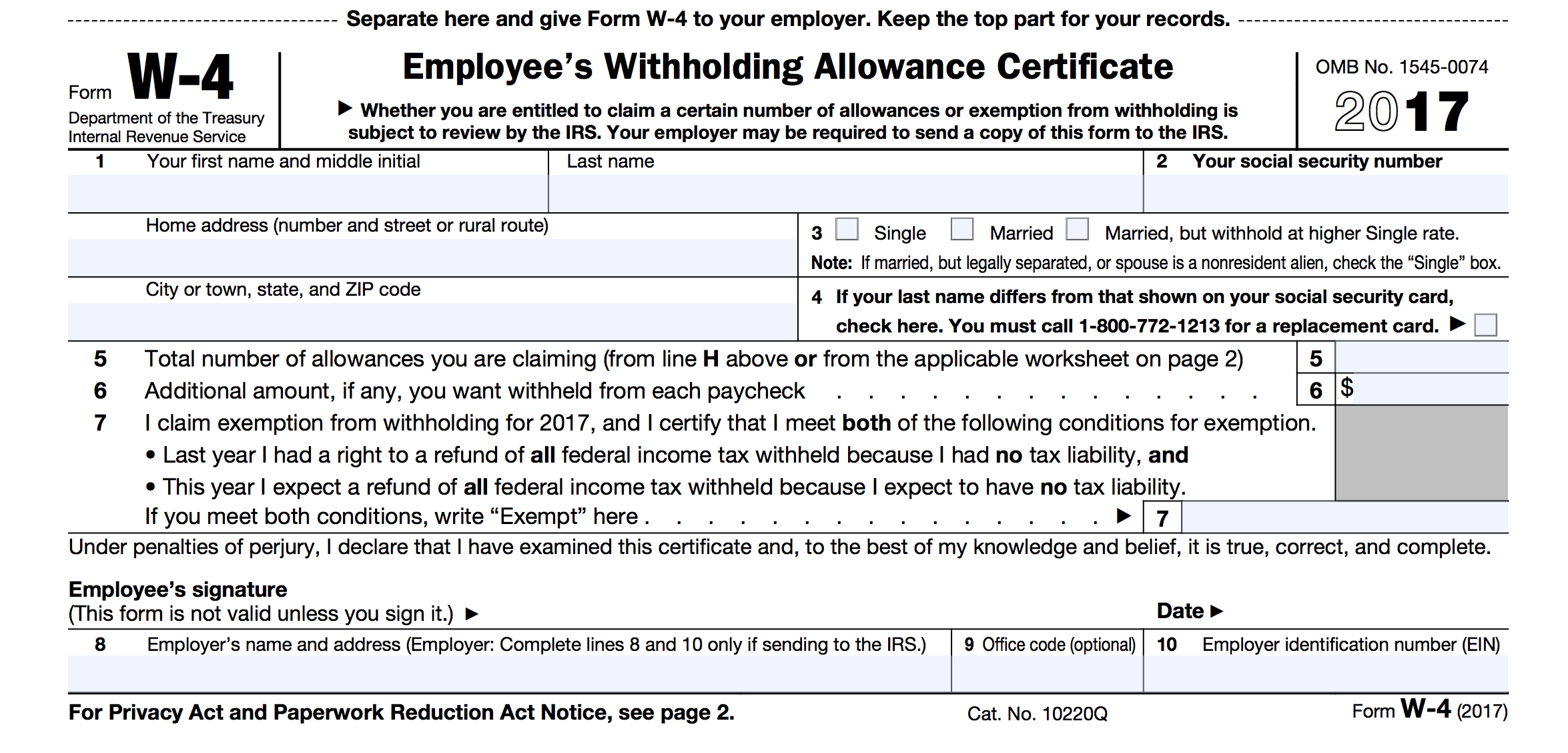

It’s crucial to know how to correctly fill out the W-4 form, as it determines the amount of tax that will be withheld from your paycheck. This sample provides a visual representation of the form filled out for the year 2021, which can give you a better understanding of what information is required.

It’s crucial to know how to correctly fill out the W-4 form, as it determines the amount of tax that will be withheld from your paycheck. This sample provides a visual representation of the form filled out for the year 2021, which can give you a better understanding of what information is required.

2020 W-9 Blank Pdf | Calendar Template Printable

The W-9 form is used to provide your taxpayer identification number (TIN) to those who are required to file an information return with the IRS. This printable version of the 2020 W-9 form allows you to easily fill in the required information.

The W-9 form is used to provide your taxpayer identification number (TIN) to those who are required to file an information return with the IRS. This printable version of the 2020 W-9 form allows you to easily fill in the required information.

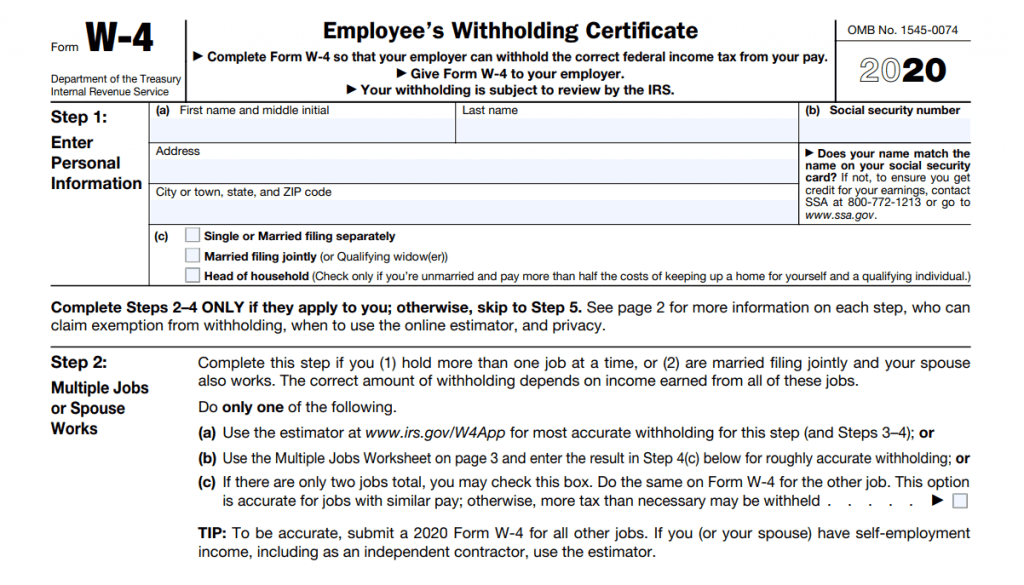

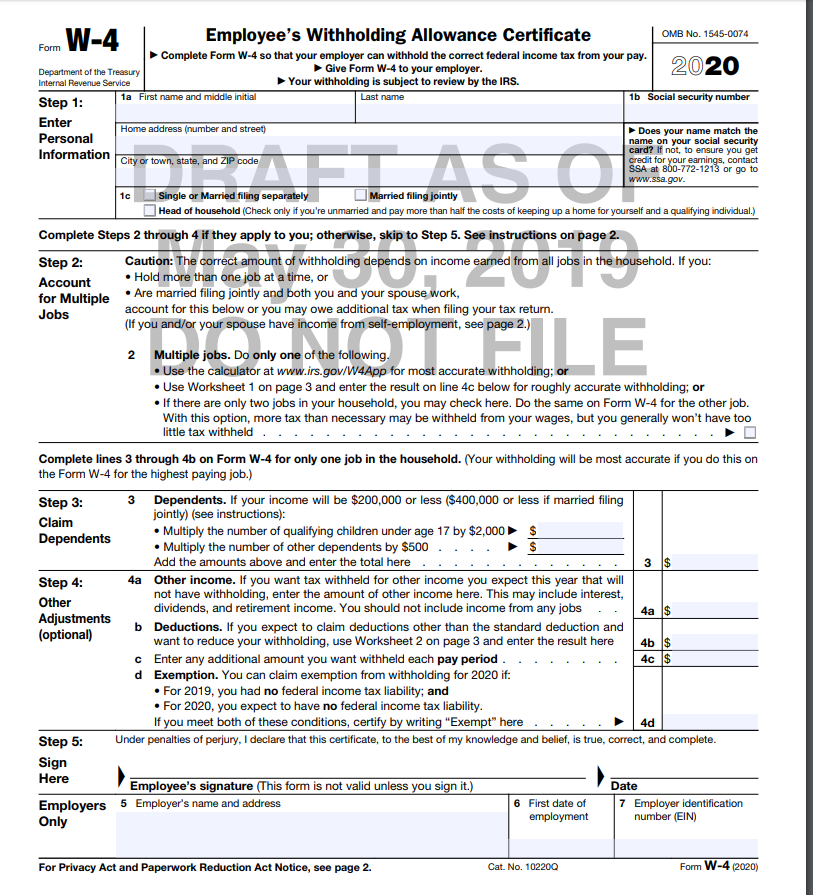

Treasury and IRS unveil new Form W-4 for 2020 | Accounting Today

The Treasury and IRS introduced a new version of the W-4 form for the year 2020. This article from Accounting Today provides insights into the changes made to the form and why it’s essential to stay informed about these updates when preparing your taxes.

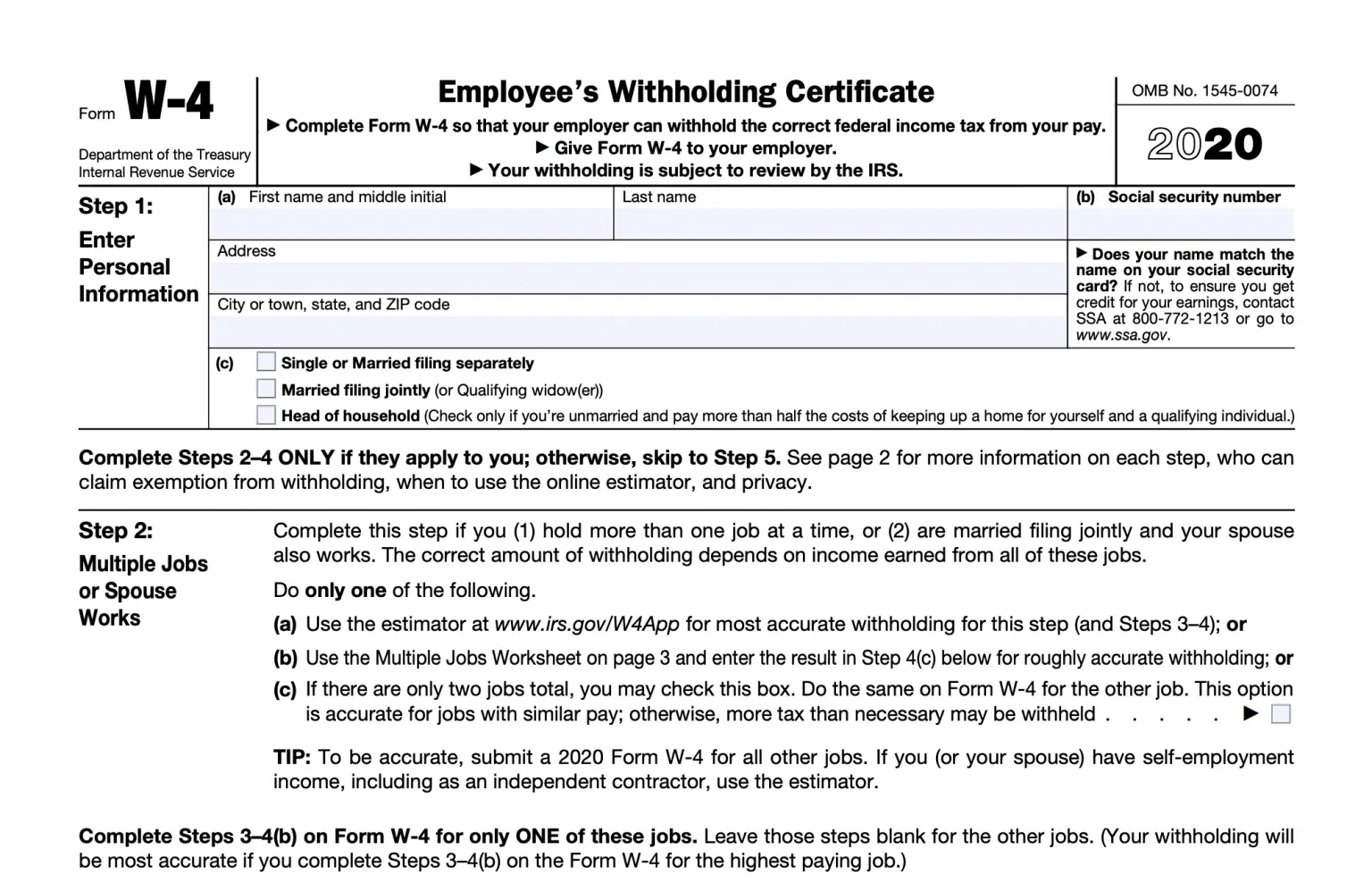

W4 Form 2020 - W-4 Forms

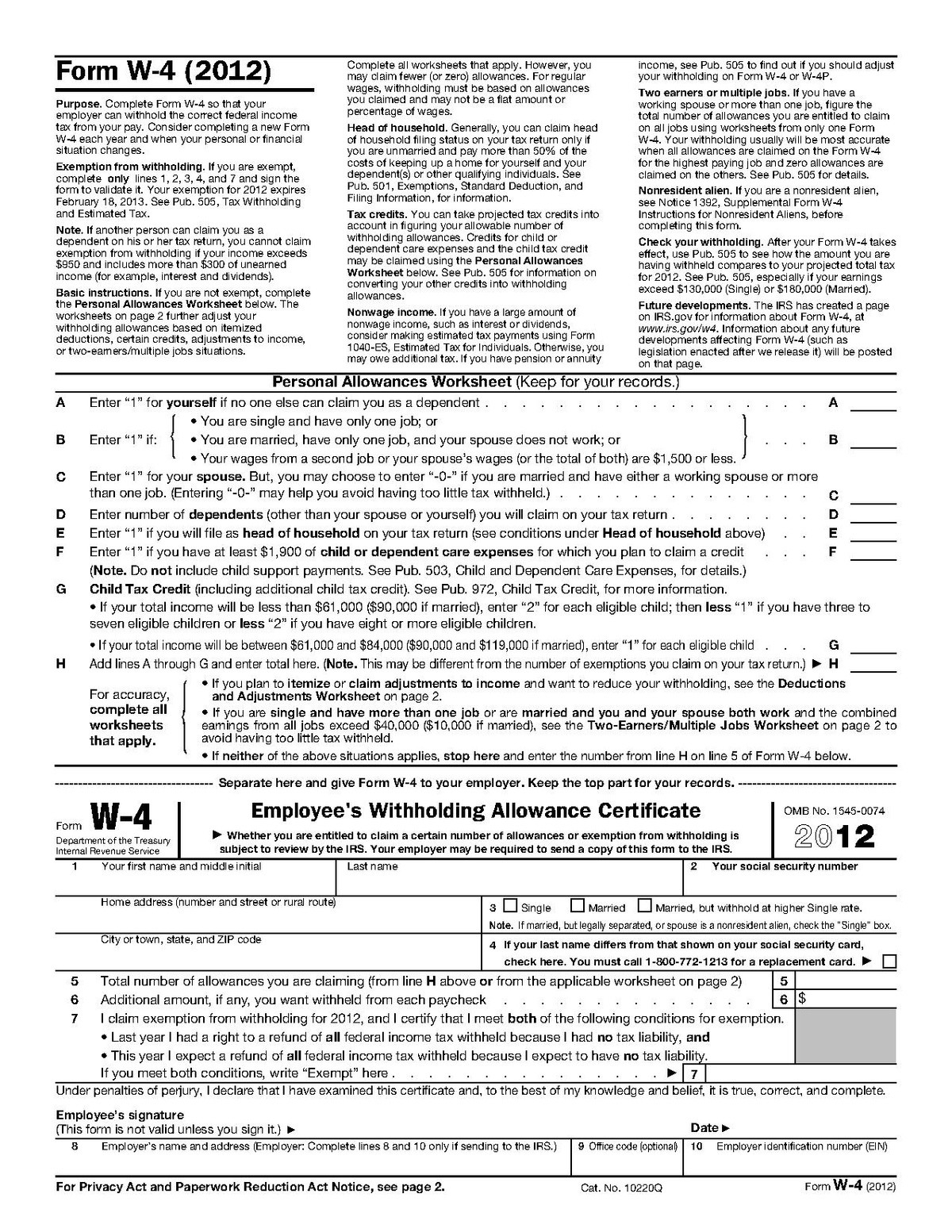

If you need to access the official W-4 form for the year 2020, this printable version allows you to easily download and fill it out accurately. It’s important to note that each year may have specific changes, so make sure you are using the correct form for the corresponding tax year.

If you need to access the official W-4 form for the year 2020, this printable version allows you to easily download and fill it out accurately. It’s important to note that each year may have specific changes, so make sure you are using the correct form for the corresponding tax year.

Printable W4 Form For Employees 2020 - 2022 W4 Form

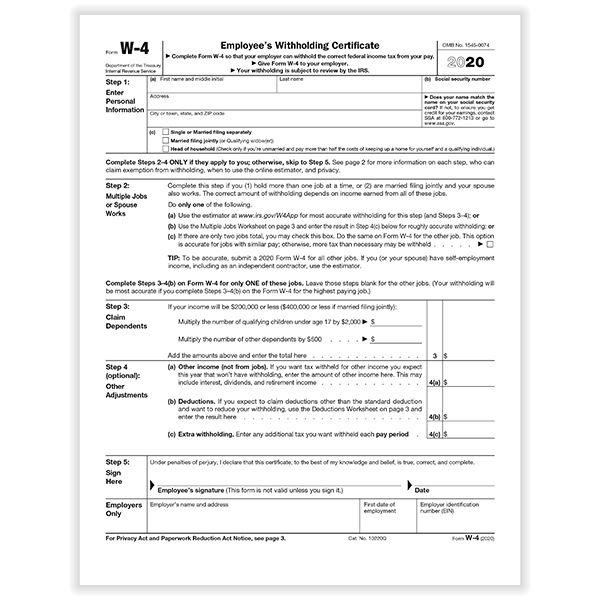

To simplify the process of filling out the W-4 form for employees, this printable version provides a user-friendly template for the years 2020 and 2022. It ensures that you have all the necessary information at hand and helps minimize any confusion surrounding the required details.

To simplify the process of filling out the W-4 form for employees, this printable version provides a user-friendly template for the years 2020 and 2022. It ensures that you have all the necessary information at hand and helps minimize any confusion surrounding the required details.

Printable W4 And I9 Forms - 2022 W4 Form

When starting a new job, you may be required to fill out both the W-4 and I-9 forms. This printable version provides a convenient way to access and complete both forms, ensuring that you have accurately provided your tax and employment authorization information to your employer.

When starting a new job, you may be required to fill out both the W-4 and I-9 forms. This printable version provides a convenient way to access and complete both forms, ensuring that you have accurately provided your tax and employment authorization information to your employer.

New W2 Form For 2020 - 2022 W4 Form

The W-2 form is a crucial document that reports your annual wages and the amount of taxes withheld from your paycheck throughout the year. This article covers the changes made to the W-2 form for the year 2020, ensuring that you are well-informed about the requirements when preparing your tax return.

The W-2 form is a crucial document that reports your annual wages and the amount of taxes withheld from your paycheck throughout the year. This article covers the changes made to the W-2 form for the year 2020, ensuring that you are well-informed about the requirements when preparing your tax return.

Should I Claim 1 or 0 on my W4 Tax Allowances - Expert’s Answer!

Deciding the number of allowances to claim on your W-4 form can have a significant impact on the amount of tax withheld from your paycheck. This expert’s answer explores the factors you should consider when choosing whether to claim one or zero allowances, helping you make an informed decision.

Deciding the number of allowances to claim on your W-4 form can have a significant impact on the amount of tax withheld from your paycheck. This expert’s answer explores the factors you should consider when choosing whether to claim one or zero allowances, helping you make an informed decision.

W4P Form 2021 - W-4 Forms - Zrivo

If you are a pension recipient, you may need to fill out the W-4P form to indicate the amount of federal income tax you want withheld from your payments. This printable version of the W-4P form for 2021 allows you to easily provide the necessary information for accurate tax withholding.

If you are a pension recipient, you may need to fill out the W-4P form to indicate the amount of federal income tax you want withheld from your payments. This printable version of the W-4P form for 2021 allows you to easily provide the necessary information for accurate tax withholding.

A New Form W-4 for 2020 - Alloy Silverstein

This informative article explains the changes to the W-4 form for the year 2020 and provides insights into why they were implemented. Understanding these changes is crucial in accurately filling out the form and ensuring that the appropriate amount of tax is withheld from your paycheck.

This informative article explains the changes to the W-4 form for the year 2020 and provides insights into why they were implemented. Understanding these changes is crucial in accurately filling out the form and ensuring that the appropriate amount of tax is withheld from your paycheck.

Remember, it’s always advisable to consult with a tax professional or seek guidance from the IRS if you have any questions or concerns while filling out the W-4 form. Providing accurate information can help you avoid potential issues and ensure a smooth tax filing process.